A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Evaluate your job offer AACSB Career Connection

The Journal Entry - October 2021 by UACPA - Issuu

Papaya Global Review & Analysis – Is It a Legit EOR?

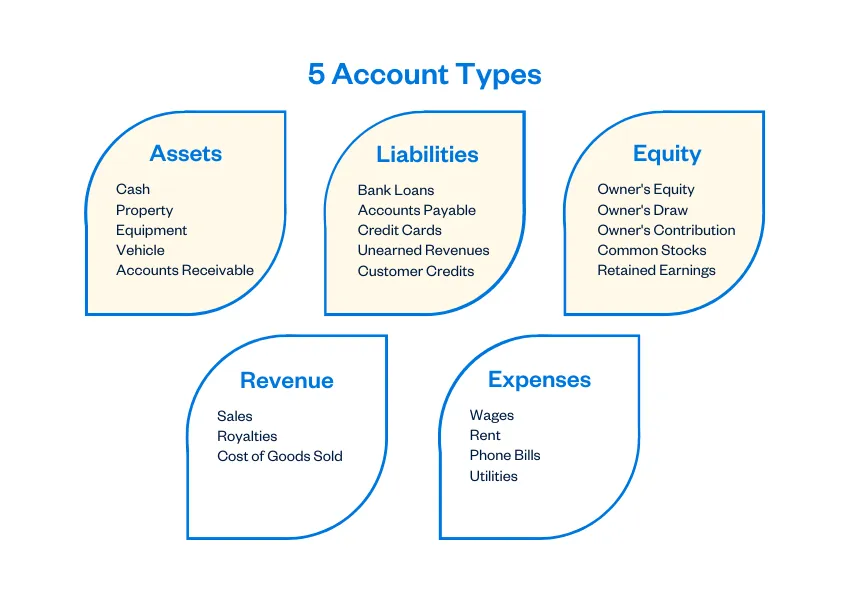

5 Different Types of Accounts in Accounting

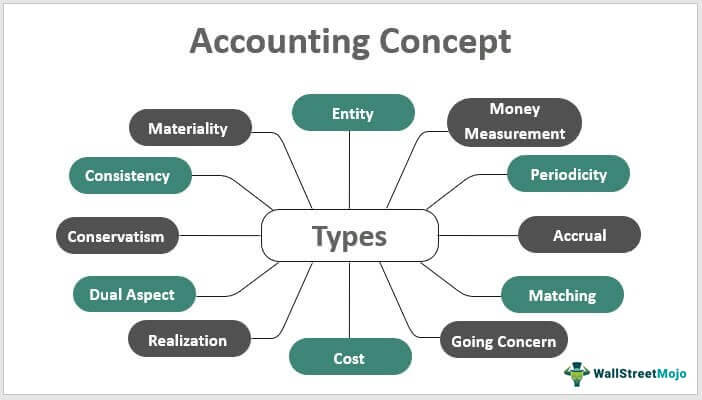

Accounting Concept - Meaning, Types, Objectives, Advantages

CPA 2021 Annual Report and Performance Review by The

What types of journal entries are tested on the CPA exam

Becker FAR - Intercompany Transaction Retained Earnings Example

Three common currency-adjustment pitfalls

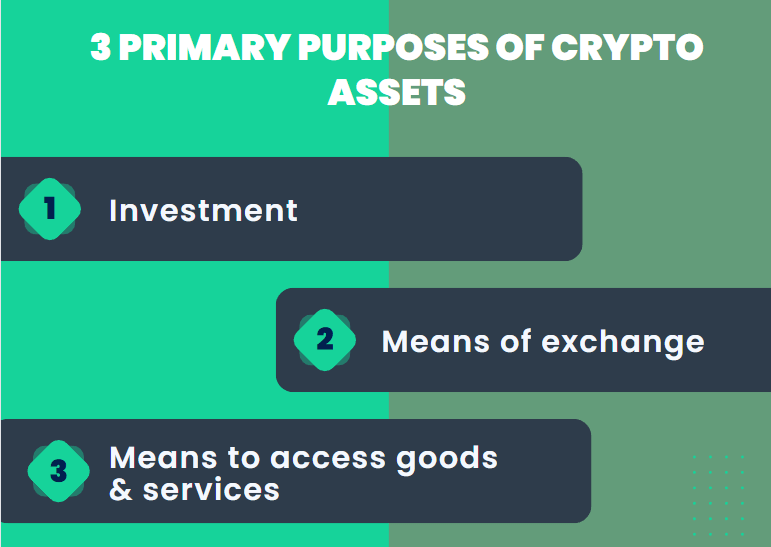

Accounting For Cryptocurrencies: All You Wanted to Know Know About Cryptocurrency Accounting [Crypto Accounting Guide]

Currency Exchange Gain/Losses

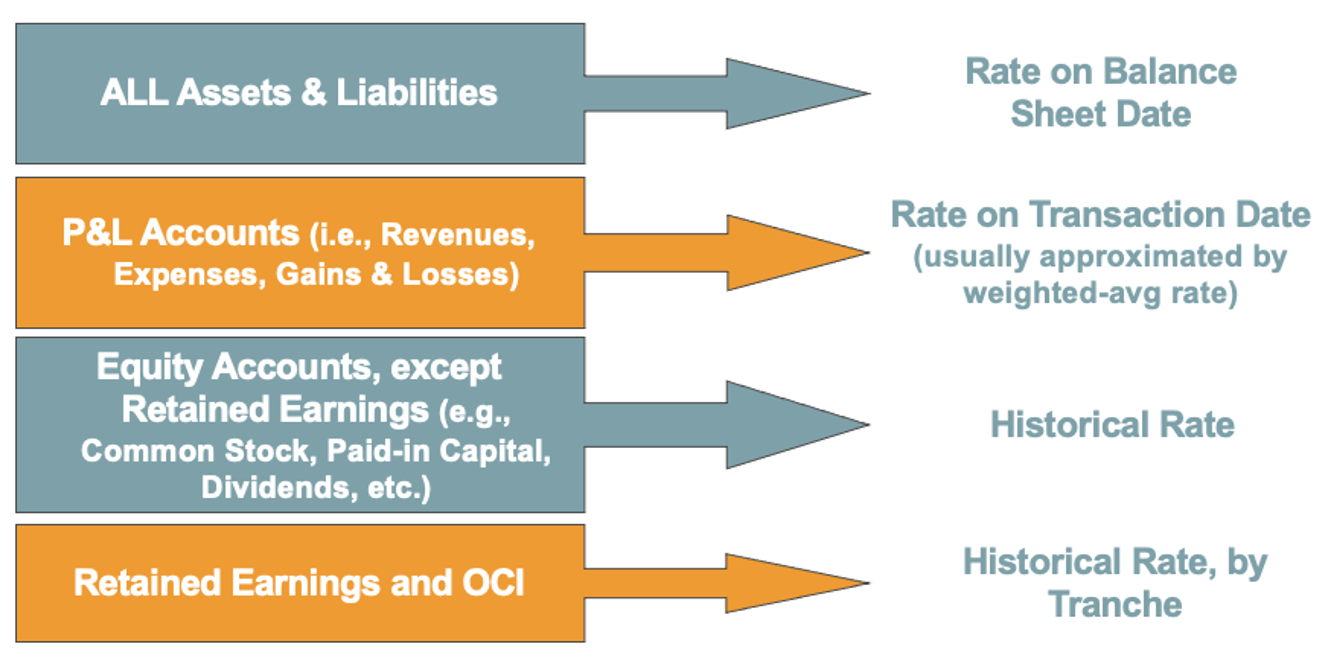

Foreign Currency Matters

Foreign currency translation vs remeasurement- Exchange rate sim

What Is a Savings Account? - NerdWallet

The 15 Best Free Online Accounting Courses - MBA Central